- Casino licensees and sports wagering operators are required to provide detailed revenue reports to the Massachusetts Gaming Commission monthly. These reports record revenue data from the most recent completed month through each licensee’s first month in operation. They are available for review on the Revenue page of the MGC website.

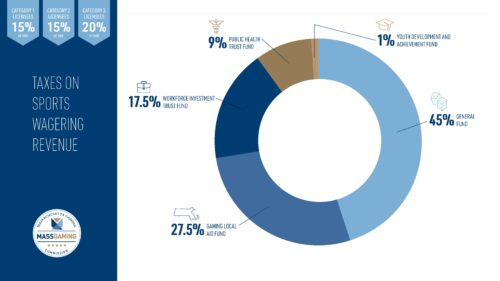

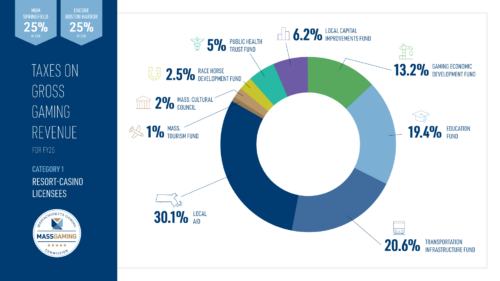

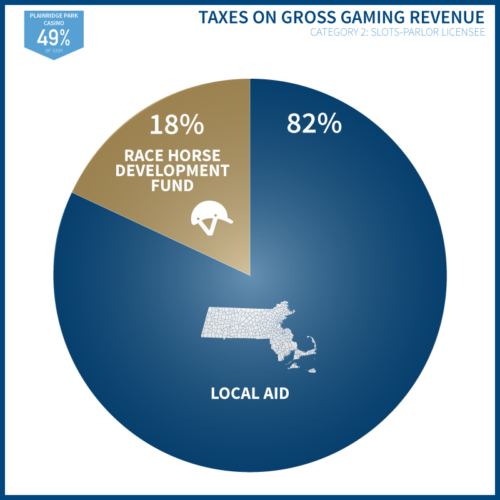

- Category 1 resort-casinos are taxed on 25% of gross gaming revenue (GGR) while the Category 2 slots-parlor is taxed on 49% of GGR. Category 1 & Category 2 Sports Wagering Licensees are taxed on 15% of gross sports wagering revenue (GSWR) while Category 3 Sports Wagering Licensees are taxed on 20% of GSWR.

- The Mass Gaming Commission has created this page to allow the public to review each of the MGC’s stylized Revenue Reports dating back to when the Commission first began publishing stylized reports in February 2023 – the first whole month of legalized sports wagering in the Commonwealth.

Revenue Reports by Year

2025

January | February | March | April | May | June | July | August | September

2024

January | February | March | April | May | June | July | August | September | October | November | December

2023

February | March | April | May | June | July | August | September | October | November | December

Allocation of Taxes

Gross Sports Wagering Revenue

Taxes on gross sports wagering revenue are allocated to the following specific state funds:

Gross Gaming Revenue

Taxes on gross gaming revenue are allocated to the following specific state funds: