What You Need to Know

- MassGaming’s licensees are required to provide detailed revenue reports on a monthly basis

- MGC will make these reports public on a monthly schedule via MassGaming.com

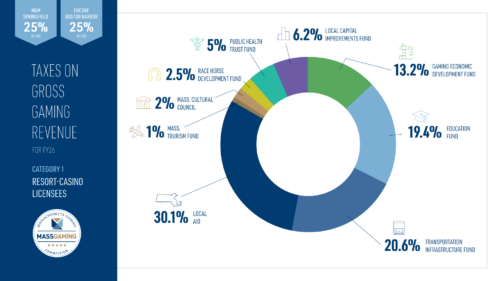

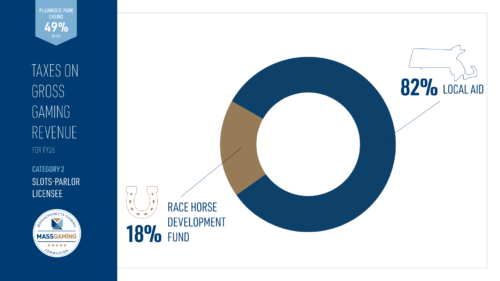

- Category 1 resort-casinos are taxed on 25% of gross gaming revenue. While the Category 2 slots-parlor is taxed on 49% of gross gaming revenue.

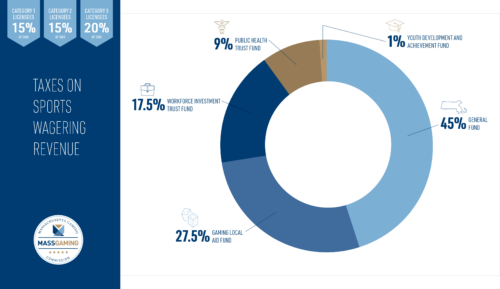

- Category 1 & Category 2 Sports Wagering Licensees are taxed on 15% of gross sports wagering revenue. Category 3 Sports Wagering Licensees are taxed on 20% of gross sports wagering revenue.

- Operators review their revenue and taxes on an ongoing basis and may update figures for a previous month at a later date. These reports will reflect the most up-to-date information.

Revenue Report

For greater viewing clarity, we recommend opening this report full-screen through the embedded copy or downloading via the previously attached file.

Note: When an operator’s adjusted gross sports wagering receipts for a month is a negative number because the winnings paid to wagerers and excise taxes paid pursuant to federal law exceed the operator’s total gross receipts from sports wagering, the Sports Wagering Law allows the operator to carry over the negative amount in tax liability to returns filed for subsequent months.

Sports Wagering Revenue Reports

Updated 6.20.2025

Category 1 Licensees

- Encore Boston Harbor (Cat. 1) Sports Wagering Revenue Report – May 2025

- MGM Springfield (Cat. 1) Sports Wagering Revenue Report – May 2025

- Plainridge Park Casino (Cat. 1) Sports Wagering Revenue Report – May 2025

Category 3 Licensees

- Bally Bet (Cat. 3) Sports Wagering Revenue Report – May 2025

- BetMGM (Cat. 3) Sports Wagering Revenue Report – May 2025

- Caesars Sportsbook (Cat. 3) Sports Wagering Revenue Report – May 2025

- DraftKings (Cat. 3) Sports Wagering Revenue Report – May 2025

- ESPN Bet (Cat. 3) Sports Wagering Revenue Report – May 2025

- Fanatics (Cat. 3) Sports Wagering Revenue Report – May 2025

- FanDuel (Cat. 3) Sports Wagering Revenue Report – May 2025

Casino Revenue Reports

Updated 6.20.2025

- Revenue – Encore Boston Harbor – May 2025

- Revenue – MGM Springfield – May 2025

- Revenue – Plainridge Park Casino – May 2025

Allocation of Taxes

Gross Sports Wagering Revenue

Taxes on gross sports wagering revenue are allocated to the following specific state funds:

Gross Gaming Revenue

Taxes on gross gaming revenue are allocated to the following specific state funds: