The Massachusetts Gaming Commission releases April 2016 gross gaming revenue for Plainridge Park Casino

- May 16, 2016

- by MGC Communications

- 0 comments

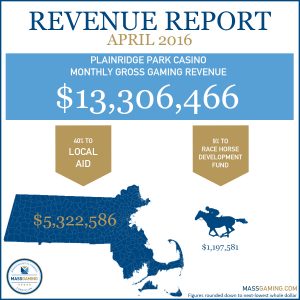

The Massachusetts Gaming Commission (MGC) reported today that the month of April 2016 at Plainridge Park Casino generated $13,306,466.10 in Gross Gaming Revenue (GGR). The category 2 slots-parlor is taxed on 49% of gross gaming revenue, of that total taxed amount 82% is paid to Local Aid and 18% goes to the Race Horse Development Fund. To date, the state has collected $68,714,692.08 in total state taxes and race horse assessments from Plainridge Park Casino since its June 24, 2015 opening.

| MONTH | Slot GGR | Coin in | Hold % | Payout % | Total collected state taxes and race horse assessments |

| April 2016 | $13,306,466.10 | $174,794,153.72 | 7.61% | 92.39% | $6,520,168.39 |

To view the complete report, please click here. MGC will continue to make monthly revenue reports available on approximately the 15th of each month.

About MassGaming

The mission of the Massachusetts Gaming Commission is to create a fair, transparent, and participatory process for implementing the expanded gaming law passed by the Legislature and signed by the Governor in November, 2011. In creating that process, the Commission will strive to ensure that its decision-making and regulatory systems engender the confidence of the public and participants, and that they provide the greatest possible economic development benefits and revenues to the people of the Commonwealth, reduce to the maximum extent possible the potentially negative or unintended consequences of the new legislation, and allow an appropriate return on investment for gaming providers that assures the operation of casino-resorts of the highest quality. For more information on MGC, please visit MassGaming.com or connect and share on Twitter (@MassGamingComm) or Facebook www.facebook.com/MAGamingComm.