MGC Releases March 2023 Casino and Sports Wagering Revenue

- April 18, 2023

- by MGC Communications

- 0 comments

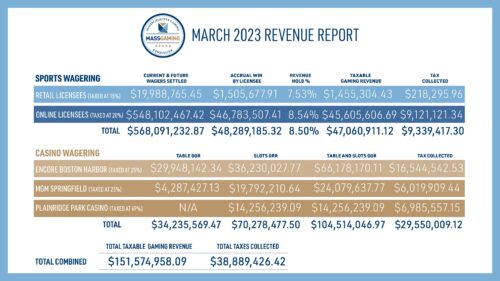

The Massachusetts Gaming Commission reported today that the month of March 2023 at Plainridge Park Casino (PPC), MGM Springfield (MGM) and Encore Boston Harbor (EBH) generated approximately $105 million in Gross Gaming Revenue (GGR).

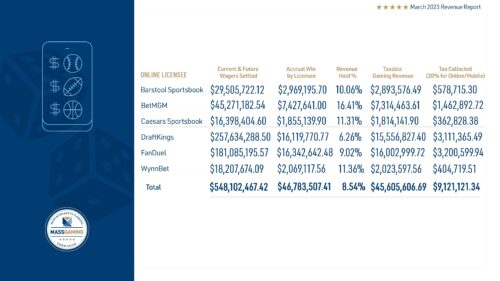

Additionally, March saw the launch of online and mobile sports wagering at six Category 3 licensees on March 10, 2023. Approximately $47.06 million in taxable sports wagering revenue (TSWR) was generated across the six mobile/online licensees and the three in-person licensees for the month of March.

Gross Gaming Revenue (casino gaming)

PPC, a category 2 slots facility, is taxed on 49% of GGR. Of that total taxed amount, 82% is paid to Local Aid and 18% is allotted to the Race Horse Development Fund. MGM Springfield and Encore Boston Harbor, category 1 resort-casinos, are taxed on 25% of GGR; those monies are allocated to several specific state funds as determined by the gaming statute.

To date, the Commonwealth has collected approximately $1.374 billion in total taxes and assessments from the casino operations of PPC, MGM and Encore since the respective openings of each gaming facility.

View comprehensive revenue reports for each gaming licensee here. MGC issues monthly revenue reports on the 15th of each month or next business day.

Note: This report has been updated to reflect the Total Hold % for wagers settled in the Commonwealth for the month of March 2023. An initial report reflected the Average Hold % for all Massachusetts sports wagering operators. Individual operator hold percentages have not been impacted by this update.

Sports Wagering Revenue

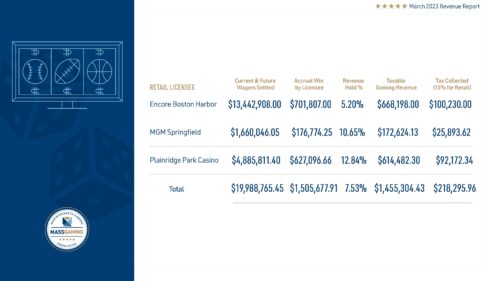

EBH, MGM, and PPC are licensed as Category 1 Sports Wagering Operators, which allows them to operate a retail sportsbook at their respective property. Category 1 operators are taxed on 15% of TSWR.

Barstool Sportsbook, BetMGM, Caesars Sportsbook, DraftKings, FanDuel, and WynnBet are licensed as Category 3 Sports Wagering Operators, which allows them to operate a mobile or online sportsbook. Category 3 operators are taxed on 20% of TWSR.

Of the total taxed amount for all operators, 45% is allotted to the General Fund, 17.5% to the Workforce Investment Trust Fund, 27.5% to the Gaming Local Aid Fund, 1% to the Youth Development and Achievement Fund, and 9% to the Public Health Trust Fund.

To date, the Commonwealth has collected approximately $9.65 million in total taxes and assessments from the sports wagering operations of licensed operators since sports wagering began in person on January 31, 2023 and online on March 10, 2023.

View comprehensive revenue reports for each sports wagering operator here.