MGC releases March 2019 gross gaming revenue for Plainridge Park Casino and MGM Springfield

- April 16, 2019

- by MGC Communications

- 0 comments

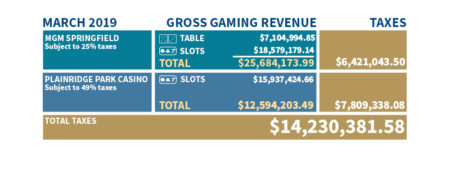

The Massachusetts Gaming Commission reported today that the month of March 2019 at Plainridge Park Casino (PPC) and MGM Springfield generated approximately $42 million in Gross Gaming Revenue (GGR). PPC, a category 2 slots facility, is taxed on 49% of GGR. Of that total taxed amount, 82% is paid to Local Aid and 18% is allotted to the Race Horse Development Fund. MGM Springfield, a category 1 resort-casino, is taxed on 25% of GGR; those monies are allocated to several specific state funds as determined by the gaming statute.

To date, the Commonwealth has collected approximately $346 million in total taxes and assessments from PPC and MGM since the respective openings of each gaming facility.

View comprehensive revenue reports for each gaming licensee here. MGC issues monthly revenue reports on the 15th of each month or next business day.