MGC Releases April 2023 Casino and Sports Wagering Revenue

- May 15, 2023

- by MGC Communications

- 0 comments

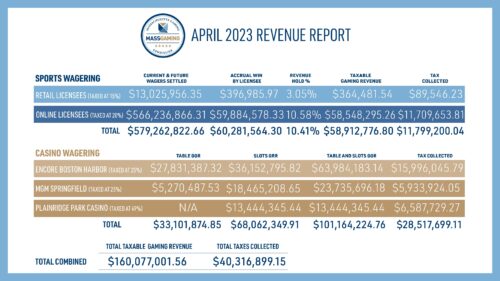

The Massachusetts Gaming Commission reported today that the month of April 2023 at Plainridge Park Casino (PPC), MGM Springfield (MGM) and Encore Boston Harbor (EBH) generated approximately $101 million in Gross Gaming Revenue (GGR).

Additionally, approximately $58.91 million in taxable sports wagering revenue (TSWR) was generated across the six mobile/online sports wagering licensees and the three in-person licensees for the month of April.

Gross Gaming Revenue (casino gaming)

PPC, a category 2 slots facility, is taxed on 49% of GGR. Of that total taxed amount, 82% is paid to Local Aid and 18% is allotted to the Race Horse Development Fund. MGM Springfield and Encore Boston Harbor, category 1 resort-casinos, are taxed on 25% of GGR; those monies are allocated to several specific state funds as determined by the gaming statute.

To date, the Commonwealth has collected approximately $1.403 billion in total taxes and assessments from the casino operations of PPC, MGM and Encore since the respective openings of each gaming facility.

View comprehensive revenue reports for each gaming licensee here. MGC issues monthly revenue reports on the 15th of each month or next business day.

Note: Due to an input error, a previous version of this chart noted incorrect totals for the online sports wagering current & future wagers settled total and the online sports wagering accrual win by licensee total. This updated version contains the correct figures for those numbers.

Sports Wagering Revenue

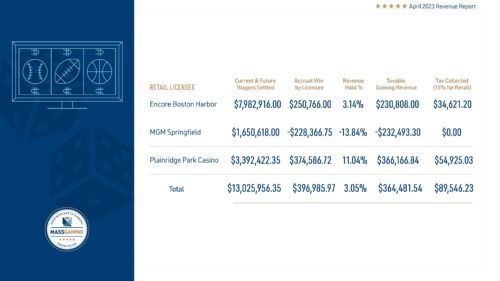

EBH, MGM, and PPC are licensed as Category 1 Sports Wagering Operators, which allows them to operate a retail sportsbook at their respective property. Category 1 operators are taxed on 15% of TSWR.

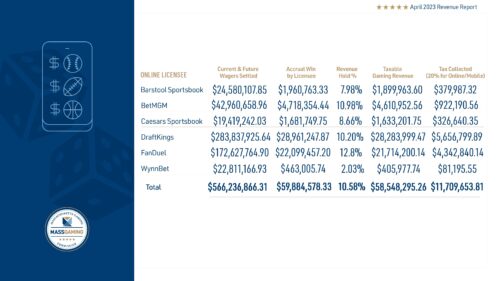

Barstool Sportsbook, BetMGM, Caesars Sportsbook, DraftKings, FanDuel, and WynnBet are licensed as Category 3 Sports Wagering Operators, which allows them to operate a mobile or online sportsbook. Category 3 operators are taxed on 20% of TWSR.

Of the total taxed amount for all operators, 45% is allotted to the General Fund, 17.5% to the Workforce Investment Trust Fund, 27.5% to the Gaming Local Aid Fund, 1% to the Youth Development and Achievement Fund, and 9% to the Public Health Trust Fund.

To date, the Commonwealth has collected approximately $21.45 million in total taxes and assessments from the sports wagering operations of licensed operators since sports wagering began in person on January 31, 2023 and online on March 10, 2023.

When an operator’s adjusted gross sports wagering receipts for a month is a negative number because the winnings paid to wagerers and excise taxes paid pursuant to federal law exceed the operator’s total gross receipts from sports wagering, the Sports Wagering Law allows the operator to carry over the negative amount in tax liability to returns filed for subsequent months.

View comprehensive revenue reports for each sports wagering operator here.